Tax Free Retirement Strategies

It’s not just about how much you accumulate….. You also need to factor taxes on retirement income.

TAX NOW TAXED LATER TAXED NEVER

Bank Accounts 403(b)/401(k)/457 Roth IRA/Roth 403(b)

Bank CD IRA/SEP IRA 7702 Plan/Permanent Life Ins.

Stocks Annuities

Mutual Funds Pension Plans

Different Ways to Save

Pre-Tax

Contribution Accumulation Distribution Heirs

Taxed Favored Tax Favored Taxed Taxed

After Tax Alternative

Contribution Accumulation Distribution Heirs

Taxed Tax Favored Taxed Favored Taxed Favored

TAX FREE DISTRIBUTIONS VIA

Loans

Withdrawals

Roth IRA/Roth 403(b) 7702/Permanent Life Ins.

7702/Permanent Life Ins.

Upside potential with downside protection

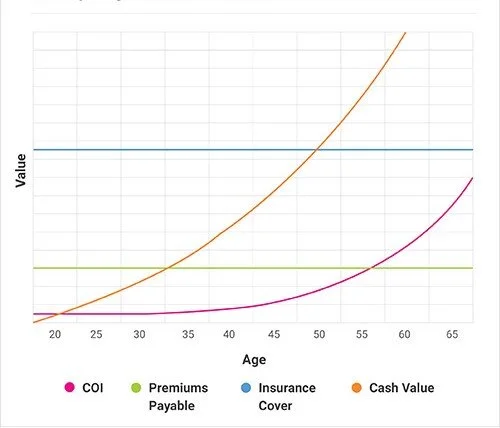

Indexed universal life (IUL) insurance provides the opportunity to earn interest based on the upward movement of a stock index. However, money is not actually invested in the stocks that make up the index.

Protection if you Die to soon, Become ill or Live to long.

Provides a death benefit and, through optional Accelerated Benefits Rider, protection while you are living if you experience a qualifying terminal, chronic, critical illness or critical injury